When was the last time you truly thought about your insurance coverage Resolution? I’m not referring to the dusty aged coverage buried in the email inbox or the just one to procure a long time back and haven’t touched since. I imply actually thought about it. For the reason that right here’s the detail—getting the proper coverage Option is like getting a security Web underneath your lifetime. You don’t Imagine much over it until you will need it, and by then, you far better hope It is really strong sufficient to catch you.

The smart Trick of Insurance Solution That Nobody is Talking About

Selecting an coverage solution isn’t as simple as finding the cheapest option or clicking “Sure” for the duration of your car registration renewal. It’s extra like selecting a journey partner for a protracted road trip. They’re with you for your ups and downs, The sleek highways, along with the pothole-ridden backroads. You would like another person (or anything) that’s trustworthy, versatile, and has your back again when items go sideways.

Selecting an coverage solution isn’t as simple as finding the cheapest option or clicking “Sure” for the duration of your car registration renewal. It’s extra like selecting a journey partner for a protracted road trip. They’re with you for your ups and downs, The sleek highways, along with the pothole-ridden backroads. You would like another person (or anything) that’s trustworthy, versatile, and has your back again when items go sideways.Now, I get it—insurance can audio uninteresting. But what if I told you It is really truly one among the neatest resources with your economic toolkit? Visualize your daily life like a video game of Jenga. Every single block you stack—your automobile, your property, your wellness, your cash flow—can be a bit of your security. The appropriate insurance policies solution? That’s the glue maintaining your tower from toppling when lifetime gets shaky.

Below’s a question to suit your needs: Are you aware which kind of insurance policy you truly have to have? Most people don’t. They get whatever they’re explained to to buy or what would seem conventional. But your insurance plan Alternative ought to be as special as your fingerprint. One or married? Youngsters or no Youngsters? Organization operator or freelancer? Homeowner or renter? Every piece adjustments the puzzle.

Permit’s bust a fantasy: insurance policies isn’t only for disasters. It’s also a strong Software for setting up. Give thought to existence insurance plan—not just a payout if you’re long gone, but a economic cushion for your family. Or overall health insurance—Of course, it covers emergencies, and also those compact, sneaky bills that insert up after a while. Your insurance solution is a proactive defend, not simply a reactive bandage.

At any time hear the phrase “you don’t know what you don’t know”? That’s very true with insurance policy. Procedures are packed with jargon—deductibles, rates, exclusions, riders. If you’ve at any time read just one and thought it absolutely was prepared in A further language, you’re not alone. That’s why finding a transparent coverage Alternative matters. You are entitled to clarity, not confusion.

Enable’s communicate cash. A typical trap is contemplating You cannot pay for insurance plan. But what you actually are unable to afford isn't obtaining it. Without the suitable coverage Remedy, 1 accident, illness, or catastrophe could wipe out many years of labor. Imagine insurance as your financial firewall. It doesn’t prevent the terrible things from happening, nevertheless it stops it from burning down your total daily life.

So, Exactly what does a modern insurance coverage Resolution look like? Adaptability, Firstly. Daily life alterations, plus your protection should really be capable of change with it. Obtained a brand new position? Purchased a house? Had a infant? Your insurance really should evolve, much like you do. Rigid policies are like jeans that don’t extend—not handy when life throws a curveball.

Then there's technological innovation. A sound insurance policies Resolution in 2025 implies mobile apps, quick quotes, electronic statements, and easy access to documents. In the event your insurance company continue to needs fax machines and long telephone calls, it’s time for you to enhance. Within a globe of one-click groceries and distant every thing, your insurance policies should be equally as easy.

Let’s not fail to remember customer care. After you’re filing a assert, the last thing you may need is really a headache. An excellent insurance policy Resolution comes along with human Explore here guidance—authentic people who care, hear, and act quick. Irrespective of whether it's a burst pipe or possibly a fender bender, your insurance company should be like a relaxed voice in a very storm, not a maze of automatic menus.

Now, let's zoom in on kinds. Well being insurance policy is definitely the heavyweight. It protects Your entire body as well as your banking account. With professional medical expenditures skyrocketing, using a strong insurance solution below isn’t just wise—it’s survival. Seek out programs with large supplier networks, clear charges, and wellness benefits. A very good coverage does more than patch you up—it retains you strong.

Motor vehicle insurance policy is commonly legally needed, but the proper plan goes beyond minimums. Assume liability, collision, and complete coverage. Accidents happen. The appropriate insurance plan Resolution signifies you’re not left shelling out from pocket or caught in infinite disputes. Reward details if it involves roadside guidance—mainly because flat tires always strike in the worst instances.

Homeowners or renters coverage is yet another essential. Envision losing almost everything to a hearth, theft, or flood. A highly effective coverage Option makes sure you’re not starting from zero. It covers possessions, temporary housing, and liability if anyone gets harm on your own home. Assurance? Priceless.

Unknown Facts About Insurance Solution

Lifetime insurance coverage, normally forgotten, is pure adore in plan kind. It’s a gift to those you permit guiding, making certain they’re fiscally steady during the worst moments of their life. A perfectly-structured insurance Alternative listed here can pay back debts, include residing bills, or fund university to your Young ones. It’s not morbid—it’s responsible.Disability coverage might not be on the radar, but it ought to be. Imagine if you bought hurt and couldn’t get the job done for months—or ever all over again? A powerful coverage Option here replaces missing cash flow, keeps the payments compensated, and allows you to deal with therapeutic in place of hustling. Visualize it as an revenue lifeline once you’re at your most susceptible.

Entrepreneurs, hear up. Your organization requirements its personal insurance policies Answer. Regardless of whether It truly is common legal responsibility, workers’ comp, or cyber insurance policies, your business faces challenges each day. Shielding this means guarding your livelihood and also your workforce. Don’t wait until finally anything goes Erroneous to appreciate your gaps.

The 2-Minute Rule for Insurance Solution

For freelancers or gig workers, the standard insurance policy entire world frequently feels from arrive at. But there are much more choices than previously. A personalized coverage Resolution can deal with health and fitness, legal responsibility, as well as revenue security. You're jogging a one particular-person present—don't depart the stage and not using a security net.

Allow’s get actual—comparing insurance policy can be overpowering. That’s where by brokers or comparison platforms can be found in. They act like matchmakers, locating you the most effective insurance policies Answer dependant on your spending plan and desires. No pressure, no guesswork. Just smarter choices.

Sustainability is yet another angle to watch. Some insurance policy firms are likely green—investing in eco-friendly projects, providing discounts for electric powered vehicles or Strength-effective properties. Choosing a sustainable insurance policy Alternative usually means protecting the two your long run along with the planet’s.

At the end of the working day, your insurance coverage Alternative must replicate your values. Have you been all about basic safety? Cost savings? Simplicity? There’s a policy to choose from that matches like your preferred hoodie—at ease, reliable, and constantly there any time you need it. Don’t settle for generic when personalized can be done.

The underside line? Coverage doesn’t ought to be Terrifying, tedious, or perplexing. With the ideal method and a little bit steering, your insurance plan Remedy can be quite a source of assurance, not stress and anxiety. It’s the peaceful hero of your adult existence—continual, reputable, and always as part of your corner when it matters most.

Edward Furlong Then & Now!

Edward Furlong Then & Now! Shannon Elizabeth Then & Now!

Shannon Elizabeth Then & Now! Tyra Banks Then & Now!

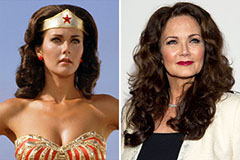

Tyra Banks Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now!